Small Business Resources to Help Businesses Navigate COVID-19 and Reopening

June 22, 2020To help Southeast Michigan small businesses navigate, the Chamber pulled together a list of federal, state, and local resources for small business owners to take advantage of as the pandemic continues.

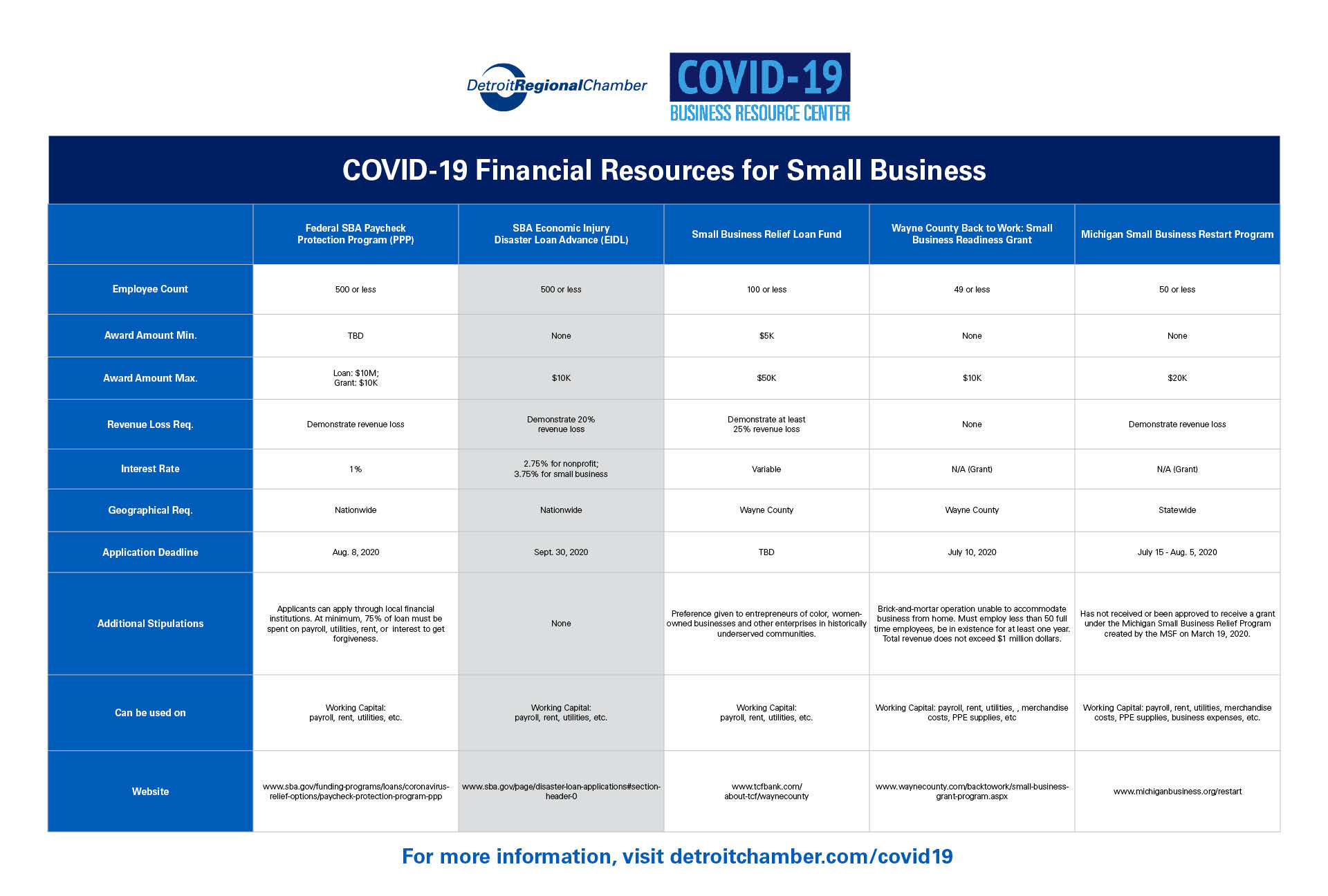

State and Local Grant Relief Options

Michigan Small Business Restart Grant Program will work with statewide economic development organizations (EDOs) to award grants to qualifying small businesses in need of assistance with payroll, rent, mortgage payments, as well as utilities and other expenses.

Participating EDOs in Southeast Michigan include:

- Flint & Genesee Chamber – $8,045,455

- Ann Arbor Spark – $8,545,455

- Oakland County – $11,045,455

- Macomb County – $7,545,455

- Detroit Economic Growth Corporation (with money allocated for Wayne County) – $15,545,450

More Resources:

- Michigan Small Business Restart Grants – FAQ

- Michigan Ag Safety Grants – FAQ

- DEGC: Michigan Small Business Restart Grants up to $20K

- Michigan Strategic Fund Approves $100M Grant Program For Small Businesses’ COVID-19 Recovery

Program applications open Wednesday, July 15 at michiganbusiness.org/restart and close Wednesday, Aug. 5.

Small Business Administration (SBA) Relief Options

- Paycheck Protection Program (PPP)

By now most, if not all, small business owners are aware of the PPP loans that the federal coronavirus relief bills created and allocated funds to. According to the SBA, there are still more than $130 billion still available as of mid-June.

- Economic Injury Disaster Loan (EIDL)

Last week, the SBA reopened its EIDL advance grant portal to a broader array of eligible small businesses and nonprofits affected by the coronavirus pandemic.

Additional Federal Funding Options:

- Federal Reserve’s Mainstreet Lending Program

As a result of the Coronavirus Aid, Relief & Economic Security (CARES) Act, the Federal Reserve has created the Main Street Lending Program to provide a total of $600 billion in financing for small and medium-sized businesses. While the program’s start date has yet to be announced, here’s what you need to know to check eligibility and get ready to apply. - Financing Your Business After Coronavirus

Not sure about the PPP or EIDL loans? Here are some other financing options to help keep your business afloat.

Additional Reopening Resources:

- Ready to Reopen: A Playbook for Your Small Business

Download this step-by-step guide to help your company reopen safely and keep employees and customers healthy and informed as restrictions lift across the country. The playbook includes safety and sanitation guidance, communications advice, and other best practices information. - Connect to Local Personal Protective Equipment (PPE) Supply

As businesses across Michigan prepare to reopen or welcome employees back, having the proper PPE to protect their employees and customers will help ensure a successful restart. The Chamber’s goal is to help connect those who have supplies with those who need supplies. - Sector-Specific Reopening Guidance

The pandemic has affected different industries differently — likewise, the reopening process will vary by sector. Here are sector-specific guidance from some of the leading industry associations and government sources:

-

- Retailers: National Retail Federation’s Operation Open Doors

- Home service providers: AIHA’s Reopening Guidance for At-Home Service Providers

- Gyms and fitness facilities: AIHA’s Reopening Guidance for Gyms and Workout Facilities

- Office-based businesses: AIHA’s Reopening Guidance for General Office Settings

- Hair and nail salons: AIHA’s Reopening Guidance for Hair and Nail Salons

Michigan Strategic Fund Approves $100M Grant Program for Small Businesses’ COVID-19 Recovery

Grant Application Open: Oakland Together Small Business Recovery Fund

$15.5M in Detroit, Wayne County COVID-19 Business Relief Grants Available, Apply Starting July 15