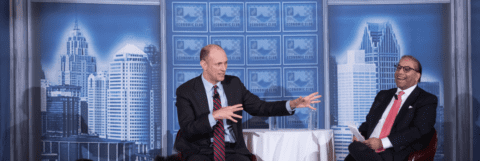

Austan Goolsbee, the Federal Reserve Bank of Chicago (Chicago Fed) President, shared enlightening thoughts on today’s economy, including this week’s CPI reports and impacts from the UAW strikes, during the Detroit Economic Club meeting on Nov. 14, 2023.

As the U.S.’s central bank, the Federal Reserve is responsible for nonpartisan monetary policy and financial system stability through a dual mandate to maximize employment while simultaneously minimizing inflation rates.

Goolsbee explained the role of the Chicago Fed within the national Federal Reserve system, which serves as the “bank of banks” to the Seventh Federal Reserve District, which includes Michigan. This “art and science” job includes conducting monetary policy, regulating banks within the district, and conducting various industry and regional research.

The Detroit Regional Chamber’s President and Chief Executive Officer, Sandy K. Baruah, was the interviewer during the discussion. In January 2023, Baruah was appointed by the Chicago Fed’s Board of Directors to serve a one-year term as the chair of the Detroit Branch’s Board of Directors in 2023.