Consumer Spending: Economic Opportunity Insight

June 13, 2020

Source: Raj Chetty, John Friedman, Nathaniel Hendren and Michael Stepner, Opportunity Insights

Consumer Spending

Consumer spending is a key component of quarterly gross domestic product.

According to the U.S. Bureau of Economic Analysis, whether you’re picking up coffee, paying for a service, or buying a car, that’s consumer spending. Spending by consumers is a significant force in the nation’s economic growth and strength. Consumer spending accounts for more than two-thirds of the economy. These statistics help inform decisions about hiring, investing, policymaking, and more.

The OI Economic Tracker calculates percent change in consumer spending by the change in average consumer credit and debt spending. The outcome is benchmarked to Jan. 4-31, 2020, and seasonally adjusted. The data comes from a company called Affinity Solutions, which tracks consumer spending, capturing about 10% of credit and debit card transactions in the U.S.

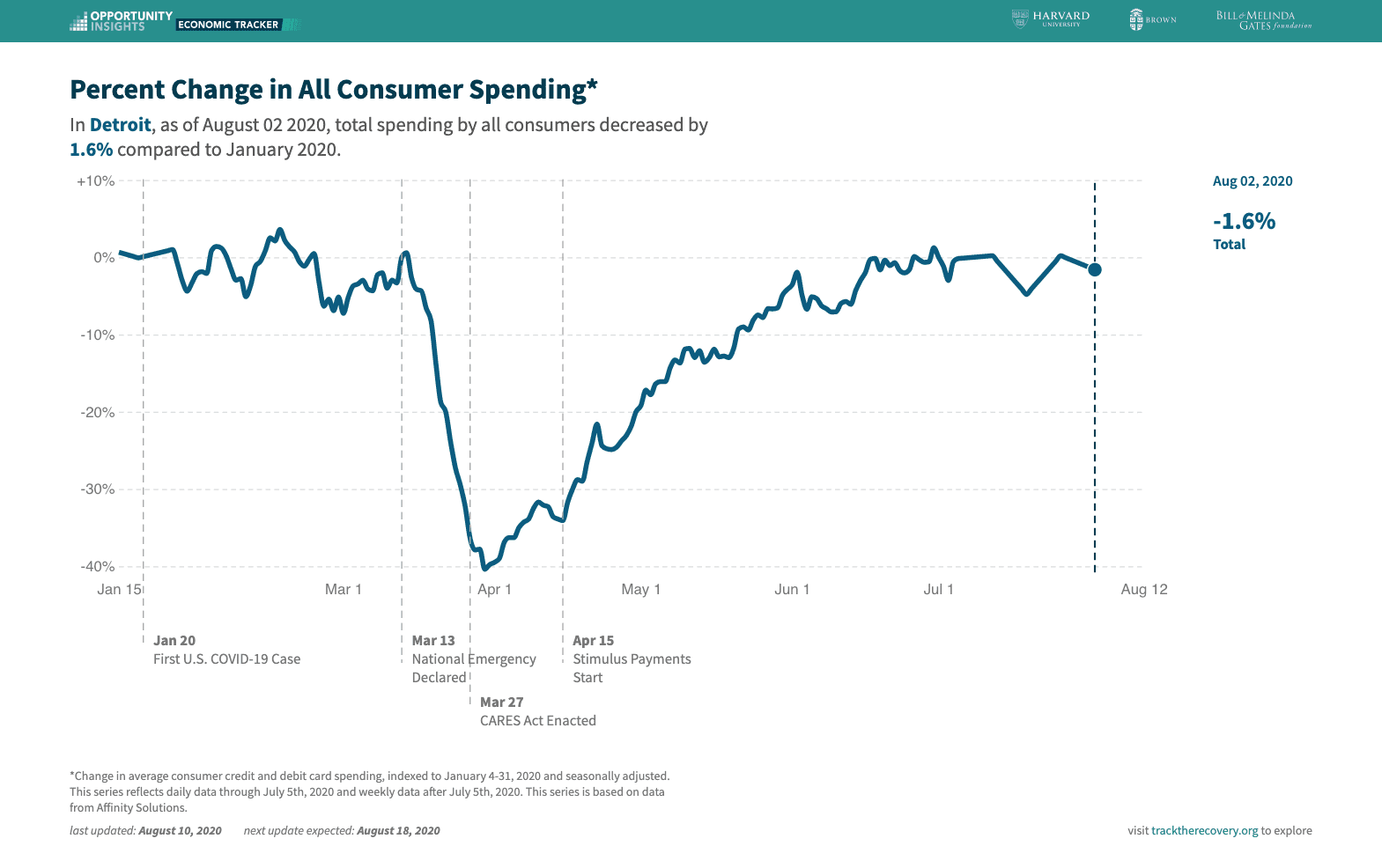

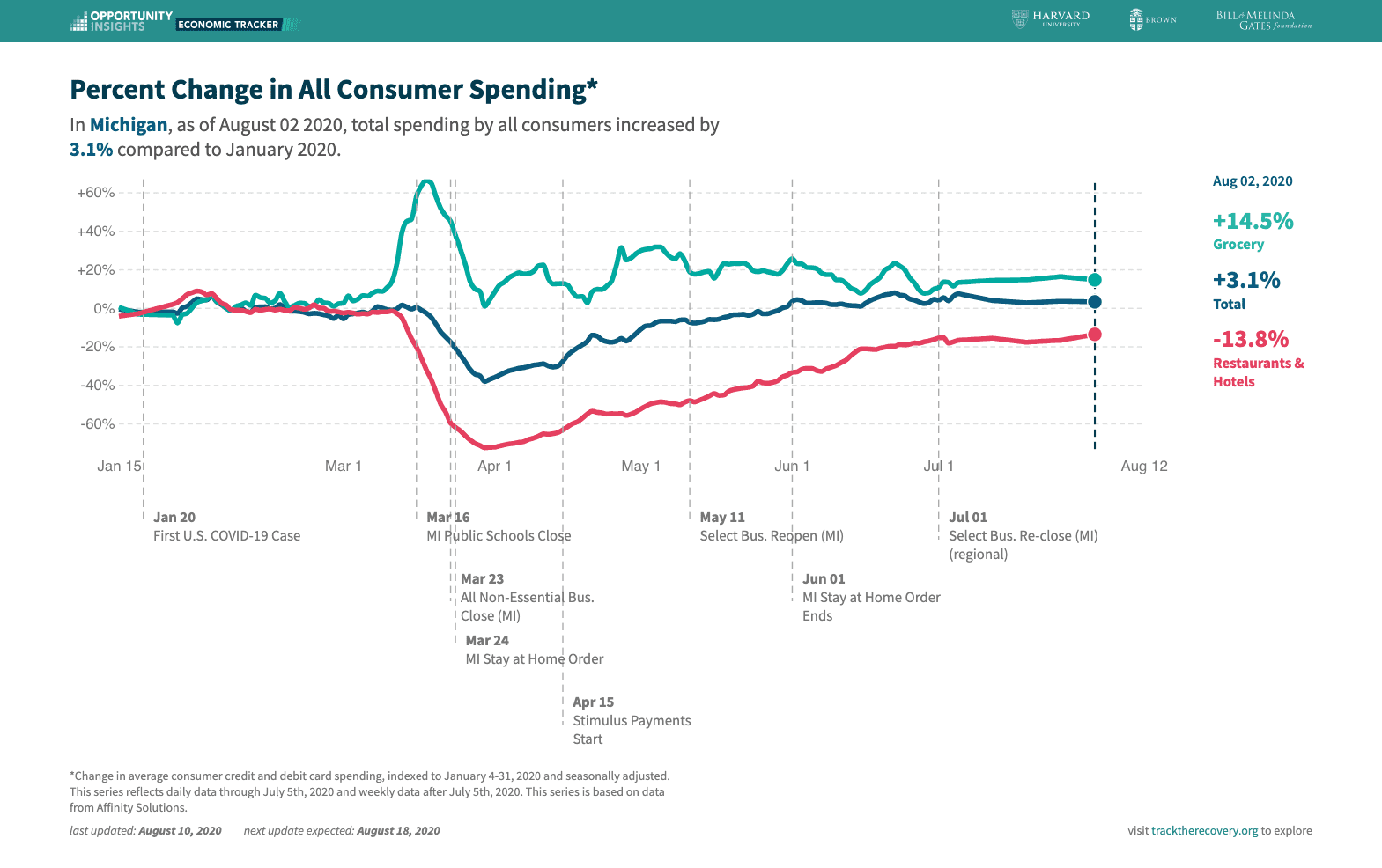

In Michigan, change in consumer spending began a steep decline in mid-March, coinciding with nonessential businesses closing, and the state’s Stay-at-Home Order going into effect. Spending levels in Michigan fell 38%, and Detroit regions’s spending fell 40% below normal in the beginning of April, before increasingly following an upward trajectory. In Michigan, as of Aug. 2, 2020, total spending by all consumers increased by 3.1% compared to January 2020. In Detroit region, total spending decreased by 1.6% compared to January 2020. In the U.S., as of Aug. 2, total spending by all consumers decreased by 8% compared to January 2020.

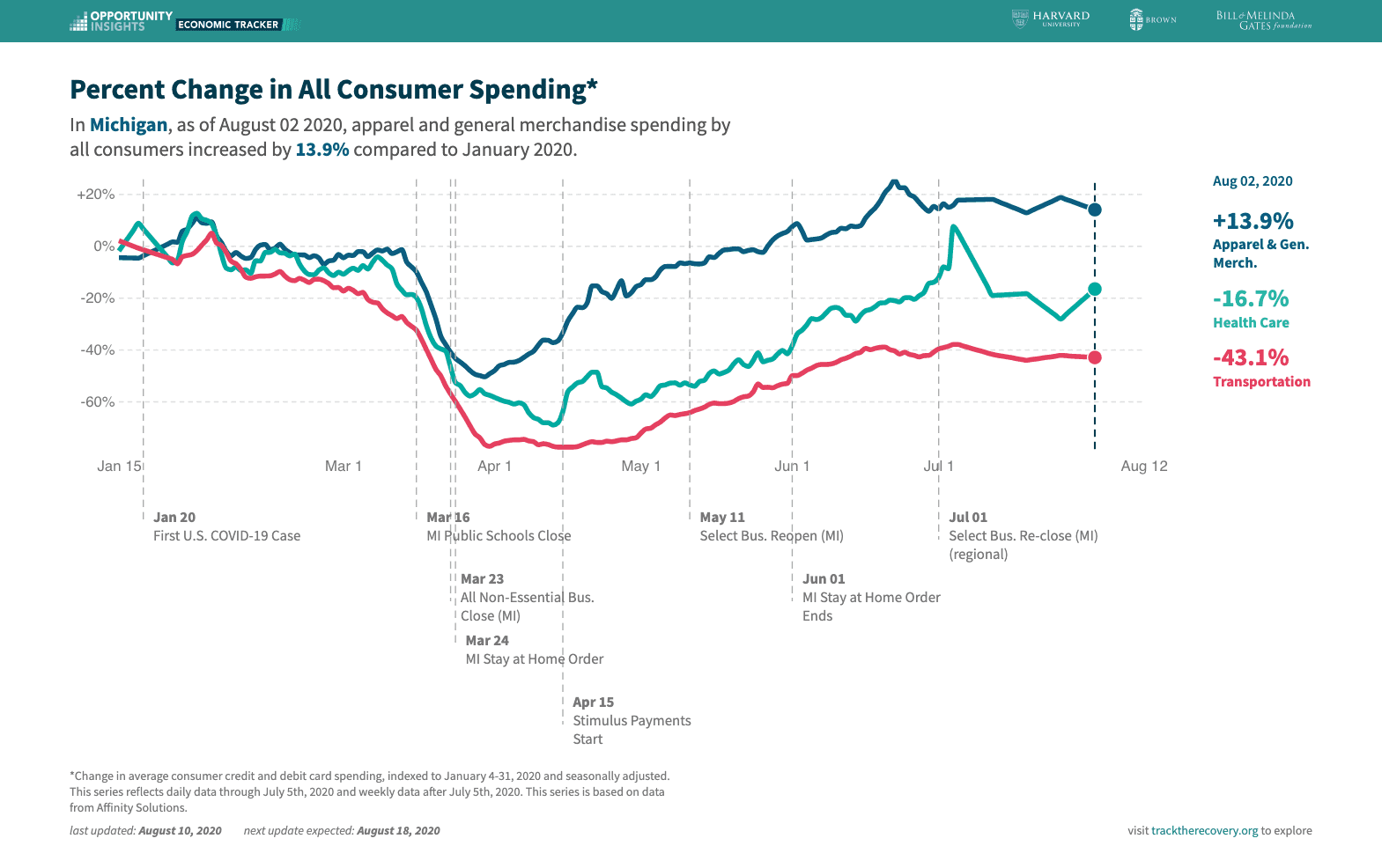

Consumer Spending by Industry

Industries across Michigan have been impacted differently during the pandemic. On March 24, a statewide Stay-At-Home Order was issued, limiting all nonessential travel and discontinuing all nonessential business like shopping malls, dine-in restaurants, museums, theaters, etc. Due to the number of shutdowns, during the beginning of the pandemic many industries saw a dramatic decline in consumer spending. Apparel and general merchandise spending decreased as much as 50% in Michigan. Transportation dropped by as much as 78%, and the arts, entertainment, and recreation plummeted as much as 77% in the beginning of April. Health care services also experienced a decrease as low as 69% in April, likely due to services like dentist and primary care offices closing during pandemic-related shutdowns.

Grocery spending saw an enormous spike during the beginning of the pandemic. Spending peaked at 65% above normal levels in mid-March and continues to be above normal levels. As of Aug. 2, spending increased by 13.5% compared to January 2020.

Reopening of restaurants and other business throughout the state unfortunately did not propel economic activity to pre-COVID levels. Many restaurants in Michigan regions are still capped at a 50% capacity, and a look at TSA traveler data shows that people are still not traveling. As of Aug. 02, Michigan restaurant and hotel spending by all consumers decreased by 13.8%, compared to January 2020. The Detroit region’s, restaurant and hotel spending decreased by 28% compared to January 2020.

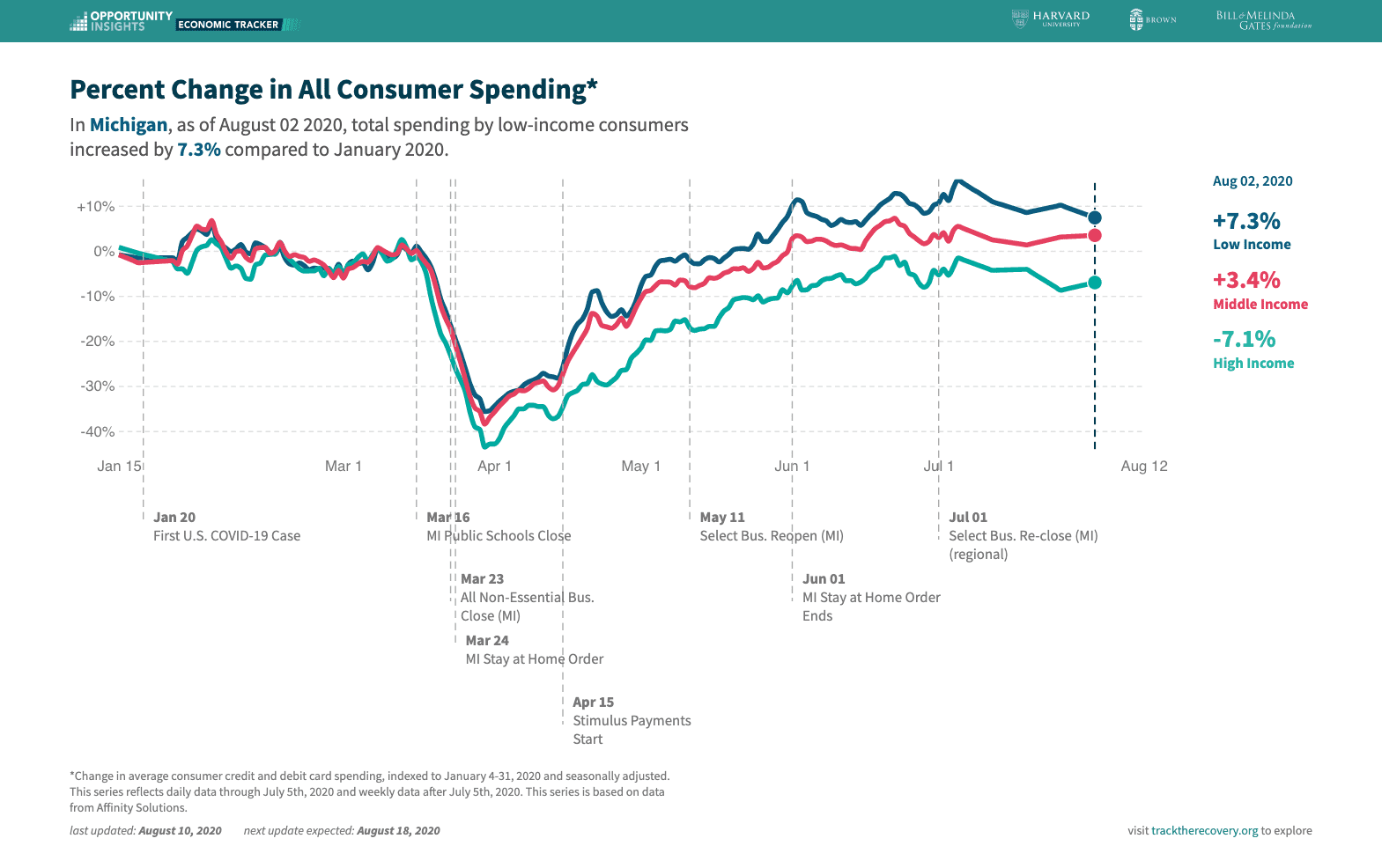

Consumer Spending by Income

Spending has collapsed considerably since the Covid-19 crisis began. But it didn’t fall evenly. According to the OI Economic Tracker, consumer spending fell sharply on March 15, when the national emergency was declared, and the threat of COVID-19 spread throughout the nation. In Michigan, high-income consumer spending fell by 43% at the lowest point, compared to 37% for middle-income and 35% for low-income households. The high-income consumer spending has recovered much more slowly. As of Aug. 2, total spending by high-income consumers decreased by 7.1%, compared to January 2020, while middle-income spending increased 3.4%, and low-income went up by 7.3% compared to January 2020.

Comparing spending after April 15, when federal stimulus checks went out; spending by low-income consumers increased almost 27%, compared to the 14% increase by high-income consumers. While spending by low-income consumers continues to rise past pre-COVID-19 levels, high-income consumers are still spending far less, and high-income spending has been much slower to return than low-and middle-income spending.