Michigan Work Share Program Expanded to Help Employers Bring Back Employees

April 30, 2020Important Work Share Funding Update

Notification of Federal Pandemic Unemployment Compensation (FPUC) ending:

The Federal Coronavirus Aid, Relief and Economic Security (CARES) Act, signed March 27, 2020, created three new federal programs for unemployed Americans as a result of the COVID-19 pandemic. FPUC provided an additional $600 a week to existing benefit amounts for programs, including but not limited to Michigan unemployment benefits, Pandemic Unemployment Assistance, Trade Benefits, and Work Share benefits. The additional benefit payments are available from April 4, 2020, through July 25, 2020.

All FPUC benefit payments will end as a result of the CARES act effective the week ending July 25, 2020. If Congress extends these additional benefit payments, we will issue updated information.

A Tool to Bring Employees Back From Unemployment

On Friday, May 29, Gov. Whitmer issued an executive order expanding who can participate in work share, giving employers greater flexibility as they open their businesses back up to the public.

Work Share serves as a great incentive for employees to return to work. While employers bring their workers back at a reduced rate, the employees could earn more than if they stay on unemployment.

The program offers many options for employers, allowing multiple plans and the option to choose which employees participate in each plan. Employers can create a plan or plans that fit their specific needs with hours reduced by as little as 10% and as much as 60%. There is only a minimum of two employees per plan, plans can be approved for up to a year and can be ended at any time without penalty. Nearly 700 Michigan employers are already participating in more than 1,700 Work Share plans.

The Michigan Work Share program was launched following the first round of federal CARES Act in March. The program allows employers to keep their employees working with reduced hours, while employees collect partial unemployment benefits. Members have expressed concerns regarding recalling their employees currently collecting enhanced unemployment benefits — as well as options for reducing employee hours. Michigan Work Share is an attractive option the Chamber strongly urges you to consider.

As a result of Executive Order 2020-57, most Work Share program eligibility requirements have been temporarily suspended. Learn more.

More:

- Bringing workers back from unemployment with Work Share – Short

- Bringing workers back from unemployment with Work Share – In-Depth

How to Apply:

Employers may file an application online through the Michigan Web Account Manager (MiWAM).

For more information, call the Office of Employer Ombudsman at 1-855-484-2636.

What is Work Share?

During this global pandemic, we know that many Michigan businesses are faced with extremely difficult choices to make when it comes to their workforce. You may be struggling to reopen your business and

reengage your employees. However, with Work Share, you may not have to. Michigan’s Work Share program allows employers to restart their business and bring employees back from unemployment. Employers can bring employees back with reduced hours – while employees collect partial unemployment benefits to make up a portion of the lost wages. Employers can also retain their current workforce and are given the flexibility to choose which of their employees are part of a Work Share plan.

Restart Operations While Retaining Employees with Work Share

A Tool to Bring Employees Back From Unemployment

How Does it Work?

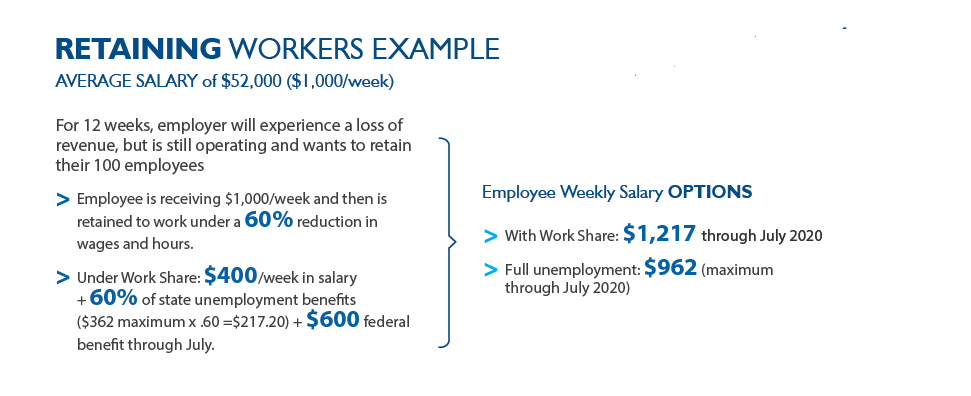

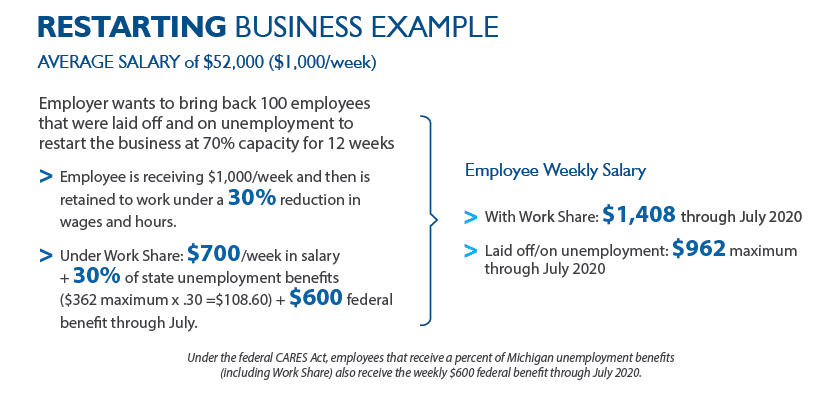

With the Work Share program, a worker receives a reduced salary from an employer, but is given a percent their state benefits plus the additional $600 federal benefit through July. The reduction in work hours must result in an equivalent reduction in wages. Example: If a worker’s weekly wages are $1,000, yet the employer needs to reduce their salary/hours by 30%. Under Work Share, their weekly salary would be $700.00 ($1,000 – 30% = $700). Plus 30% of their state unemployment benefits ($362 maximum x .30 =$108), plus an additional $600 federal payment through July. With Work Share, the employee would earn $1,408/week through July 2020 vs. $962 without Work Share. As businesses are reopened, Work Share can help employers bring back their employees from unemployment faster and allows employers to retain their workforce and avoid layoffs.

Advantages of Work Share

- Minimizes or eliminates the need for layoffs.

- Enables a business to retain trained employees and avoid the expense of recruiting, hiring, and training new employees while business demand is reduced.

- Saves money and keeps your skilled workforce intact.

- Can be used in almost all types of business or industry.

- Employees are provided partial unemployment to offset or replace income losses.

- Allows you to restart your business as Stay Home restrictions are relaxed.

Who Can Participate?

Work Share Under Executive Order 2020-57

As a result of Governor Whitmer’s Executive Order, Michigan’s Work Share program eligibility requirements have been expanded:

- If business demand is down, employers participating in Work Share can preserve their workforce while reducing hours and wages by 10 – 60%.

- Waived the length of time required that employers must be in business.

- Waived the requirement that employers NOT have a previous history of layoffs.

- Waived the requirement that employers have a current or positive balance with UIA.

Program Requirements:

As a result of Executive Order 2020-57, most Work Share program eligibility requirements have been temporarily suspended. Employers must meet and maintain the following requirements in order to participate in the Work Share program:

- Employers are given flexibility to organize which employees are in a Work Share plan.

- A plan must include a minimum of two employees.

- Plans may be approved for a period of up to 52 consecutive weeks.

- Employee hours/wages may be reduced by a minimum of 10% up to a maximum of 60%.

- Part-time employees are eligible, but Work Share does not apply to seasonal, temporary, or intermittent employment.

- Employees must be eligible to receive state unemployment benefits.

- Employer must obtain approval of any applicable collective bargaining unit representative.

- Employers participating in Work Share cannot modify employees fringe benefits.

How to Apply:

Employers may file an application online through the Michigan Web Account Manager (MiWAM).

For more information, call the Office of Employer Ombudsman at 1-855-484-2636.

Temporary Leave vs. Termination

Due to the uncertainty regarding potential congressional action on how furloughed workers will be able to access federal resources, employers are strongly urged to place employees on temporary leave as opposed to termination. There is no additional cost to employers, employees remain eligible for unemployment benefits and they may remain eligible for potential federal assistance. Steps for employers placing employers on temporary unpaid leave:

- Do not terminate the employee – specify a temporary/indefinite leave with return to work expected that is within 120 days.

- Do not create a contractual obligation to bring the employee back to work – let the employee know that the situation is fluid and subject to change.

- Provide the employee with a formal Unemployment Compensation Notice. Employers will need to provide their Employer Account Number and Federal Identification Number.

- Communicate to the employee about their rights. Under Governor Whitmer’s recent Executive Order, workers placed on leave, or are unable to work because they are sick, quarantined, immunocompromised, or have an unanticipated family care responsibility, are eligible for unemployment insurance benefits.

- Ensure employers are provided information on how to obtain unemployment insurance benefits. A factsheet can be found here.

More Resources:

Restart Operations While Retaining Employees with Work Share

- Dykema: Bringing Employees Back to Work Post-COVID-19: What Is Michigan’s Work Share Program and Should Employers Take Advantage of It?

- Crain’s Detroit Business: How Laid-off Michigan Workers Can Collect Unemployment and Go Back to Work Part-time

Testimonial:

Jeffrey Douma, Director of Human Resources

MAG Automotive, Sterling Heights

This year, COVID-19 forced all of our customers and suppliers to delay all business deliveries and timelines. Mass layoffs of our workforce would imperil our existence. Cutting all of our employee’s hours and turning to Work Share became our only option for these times.

Working with the Work Share Team and implementing a planned “return-to-work” approach, we were able to maintain all benefits for our employees and reduce work hours of 60% of our employees. We implemented Work Share Groups at all levels. MAG saved payroll costs and allowed us to efficiently manage our future work. Most importantly, this Work Share approach provided assurance to all our employees that MAG would come out of these times unified, prepared, and safely.

As challenging as these times have been and with the work overload thrown at the Work Share Team, MAG has received high support from its team members. Work Share has truly been a remarkable gem.